Latest News

12/10/2024

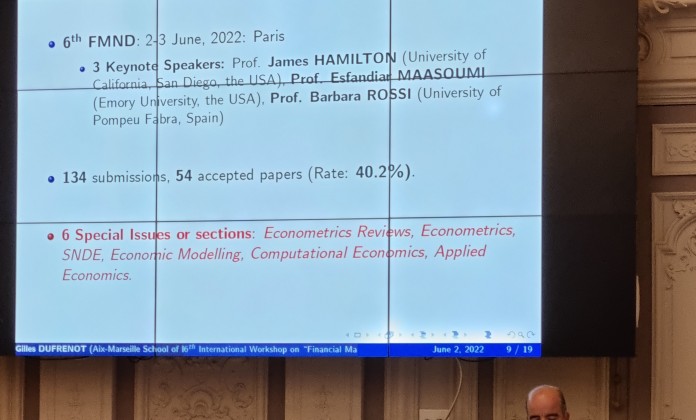

The 9th edition of International Workshop in Financial Markets and Nonlinear Dynamics (FMND) will…

Read more9th International Workshop on “Financial Markets and Nonlinear Dynamics” (FMND), 5-6 June 2025, Paris

Note: We are sending the decisions regarding the 9th edition of the International Workshop on Financial Markets and Nonlinear Dynamics (FMND), which will be held on June 5-6, 2025, in Paris. Registration is now OPEN.

If you do not receive our decision this week, please check your spam folder and keep us informed.

Welcome to the 9th edition of International Workshop in Financial Markets and Nonlinear Dynamics (FMND, June 5-6, 2025 in Paris). We are happy to organize this event, allowing both scholars and finance professionals alike to exchange and confront innovative and thought-provoking ideas about financial market dynamics and nonlinear econometrics.

The Workshop will take place in Paris from 5 to 6 June 2025 with the collaboration of the Internationational Association for Applied Econometrics (IAAE), the Institute for Nonlinear Dynamics Inference (INDI), the French Finance Association (AFFI), the IAE Lille University School of Management (LUMEN), Aix Marseille School of Economics.

Co-sponsors

The International Association for Applied Econometrics (IAAE)

IAE Lille University School of Management (LUMEN)

Keynote Speakers:

Prof. Yacine AIT-SAHALIA (NBER & Princeton University, the USA)

Prof. Iftekhar HASAN (Fordham University, the USA)

Prof. Hashem Pesaran (University of Southern California, the USA)

Organizers:

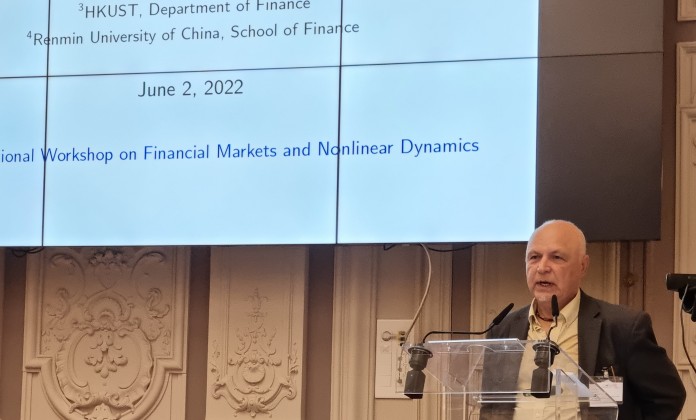

Prof. Gilles DUFRENOT (Sciences Po Aix, France)

Prof. Fredj JAWADI (University of Lille, France)

The submission system is managed via the Workshop website at: http://fmnd.fr/submit-your-paper.html . Please submit your full paper in PDF format, following the instructions there. You may also want to look at the Call for Papers to see the exact list of topics covered by the conference. You can also submit your paper by email at: nd.mm2012@gmail.com

There are interesting publishing opportunities associated with our workshop, in particular some selected papers will be considered for publication in a special issue of International Journal of Finance and Economics (ABS 3), a special issue of Macroeconomic Dynamics (ABS 2), a special issue of Studies in Nonlinear Dynamics and Econometrics (ABS 2), etc.

We all look forward to welcoming you in Paris in June 2025!

Topics covered:

We are looking for papers that might include (but are not restricted to) theoretical, experimental and empirical research in finance and/or econometrics in the following areas:

Finance : Empirical Finance - Quantitative Finance- Experimental Finance - Computational Finance - Behavioral Finance - Green and sustainable Finance - Stock Markets Dynamics - Exchange Rate Dynamics - Cryptocurrencies - Blockchains and crypto assets- Market Microstructure - High Frequency Trading - Optimal trading - Market Analysis- Order Book Dynamics - Algorithmic Trading - Market Liquidity modeling - Electronic Market - High Frequency data analysis - Price Discovery - Market Organization - Market Regulation- Efficiency & Price dynamics - Asset Pricing Models – Portfolio Choice – Portfolio Insurance- Derivatives Pricing - Volatility Dynamics- Risk Management -Market imperfections- information asymmetry - Bubbles - Uncertainty & investor sentiment - Financial Intermediation - Banking and Investment – Inflation and Central Banking- Financial crisis - Extreme Risk and Insurance - VaR & CoVaR- Expected Shortfall- COVID-19 & financial markets – Pandemics and financial markets - commodities price dynamics- Energy Finance - Commodity Prices , Geopolitical Tensions and commodity price volatility, etc.

Econometrics : Econometric Theory, Applied Econometrics, Financial Econometrics Financial Mathematics - Financial Engineering – Machine Learning- Nonlinear Dynamics - Copulas - Nonlinear Time Series - State Space Models - Threshold Modeling - Switching Regime Models - Markov Switching Models - Linearity and asymmetry Tests - Nonlinear Causality Tests - Nonlinear Panel Models – GARCH Modeling – STR-GARCH models - Long Memory Models- Chaotic Models- Quantile Panel Regressions - Neural Network models - Modeling Extreme events -Time Series - Cointegration and causality - Bayesian Analysis - Non Parametric Models - Wavelet and Spectral Analysis - Simulation Methods - Forecasting, etc.

Important dates

Please notice the following important deadlines:

Deadline for submission: Feb 28, 2025.

Notification of final decision: March 15, 2025.

Early Bird Registration: March 15, 2025 - April 15, 2025.

Dates of the workshop: June 5-6, 2025.

Dates of the workshop: June 5-6, 2025.